09 Feb Tax Reduction Strategies for Executives and High-Income Earners (2022) – Podcast

In today’s episode Nicholas Olesen, CFP®, CPWA® shares the top tax reduction strategies we have advised executives and other high-income earners to take advantage of.

Taxes are probably the one thing just about everyone feels they pay too much of. For executives and high-income earners, it is by far the largest expense they pay each year and for many it costs them over 50% of their income.

Nicholas starts off with a little tax terminology and education and then shares what he have seen as the most impactul strategies. Here’s a few topics covered:

- Difference between tax bracket, marginal rate, and effective rate

- Deductions vs Credits and how to maximize both

- How past legislation can give us insight into the future for tax law

- The 4 strategies that you need to be doing today

You can find a transcript of today’s show below.

We would love to help! Please reach out for help or send us feedback and any topic or questions you would like us to cover. Email us at: [email protected]

To listen to all our episodes and receive them as we publish, please subscribe to our podcast on your favorite app:

Transcript from today’s show:

Tax Reduction Strategies for Executives

[00:00:00] A wealth of advice is an open exploration of ideas and actionable advice with the goal of helping you to achieve your personal aspirations. The team at Kathmere Capital and their guests strive to deliver thoughtful insights on how to manage your wealth, realize successes in your career and live a healthy personally fulfilling life.

Hi, thanks for tuning into A Wealth of Advice. My name is Nicholas Olesen, Director of Private Wealth at Kathmere Capital.

What are the top tax reduction strategies that I should use?

That was a question that we recently got when we were talking through 2022 planning and beyond for a high-income earner, that’s an executive. And I thought it was a great question, and one that we talk around through tax saving strategies and saving strategies, in general. We talk about that with charitable donations, but I thought it’d be really great to just kind of have one full episode that:

- Dives into tax terminology

- Goes through kind of some legislation that’s in place right now and what might, come in the horizon

- Talks about how taxes are calculated

- Explains the differences between deductions and credits

- And then covers top strategies that we’ve seen for those on the higher income level, and also those that just want to have kind of an understanding of what they can do.

So let’s kick off with some tax terminology.

First is brackets. I hear a lot of people talk about, “I’m in the X percent bracket”, so on and so forth. But just to go through that in the United States here, we have a progressive tax code.

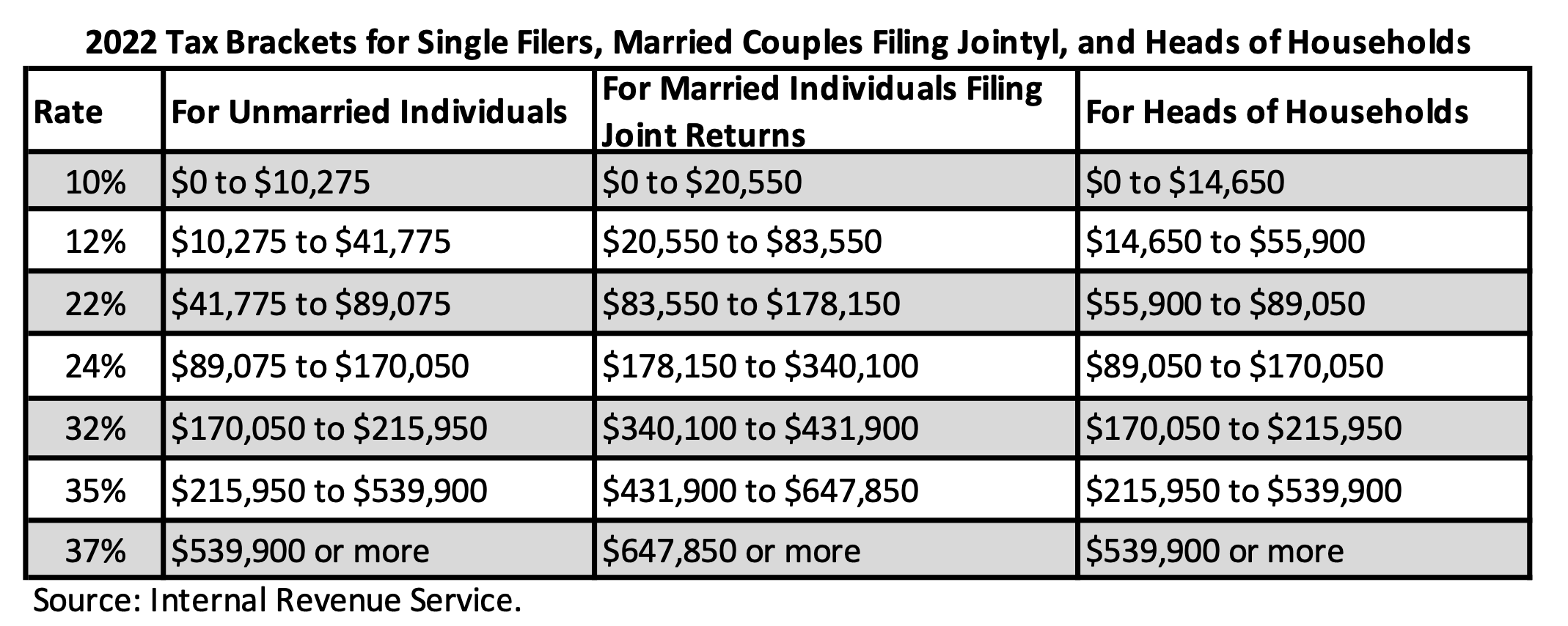

What that means is that everybody’s income is taxed as they go higher at a higher income rate. The first X dollars, anywhere from 10 to 20,000, depending if you’re single or married. The next rate is 12% and jumps to 20% to 24%, then jumps 30% to 35% and 37% tops us out. And the way that it works, is your first, we’re going to use married filing jointly for all these, the first $20,000 of income that you receive is taxed at 10%. The next call it $60,000 from $20-84,000 is taxed at 12%. And so on. See chart below:

What’s important is kind of where you fall in that bracket and then what you can get to from either having more income come in, i.e. the next dollar or what you can get to as far as cutting it down from taking credits or deductions, and the highest bracket starts a 37%.

That highest bracket for a married filing jointly starts at $647,850. So, every dollar above that as tax at 37%. And for singles that’s $539,900.

Hopefully this just puts some perspective around what these are.

These brackets are important because the bracket lines up with something called your marginal rate. Your marginal rate is what is your actual tax rate that you would pay for that next dollar of earnings coming into.

When you look at a couple, for example, if you have call it 350,000 in income, you’ve actually all of a sudden gone into 32% tax bracket. So, every additional dollar that you have coming in is going to tax that tax at [00:03:00] 32%.

If you can somehow bring your income down, whether that’s through charitable nature tunes, or retirement plan contributions, or an HSA or mortgage deduction, you name it, you can bring that income down. Once you get below 340,000 and a hundred dollars, you then drop all the way down to the 24% bracket. So, your bracket or your marginal rate can be kind of interchangeable terminology.

And the other one that we hear a lot is effective rate. So that’s kind of an easy calculation, you look at your total taxes that you paid, divide that by your total income you had coming in and that’ll give you effective. Some people look at your effective rate off of your taxable income. Others look at just to get your total income coming in. Those are different numbers, which I’ll touch on in just a second.

Now what’s key when we look at it for individuals and for the families that we serve is really kind of figuring out what is your brackets today or your marginal rate today? Where do we think that’s going to be in the future and if we do something today to lower or increase the amount of income you have coming in through donations or credits or tax loss, harvesting, or tax gain, harvesting on your investment side of it, what happens to your taxes over your lifetime?

And if you look at the way that our tax system is, they use this taxable income to really determine your deductions and your credits that you can take. So, it’s actually very key when we are talking through different tax strategies or different ideas here to understand that if we are able to lower your income to a certain amount, maybe we’ll start receiving a credit or a deduction that you previously would have been not allowed, or you would have been over the income limit for it cause a lot of those are income-based phase-outs.

Capital Gains Taxes

The other thing, when we talk about taxes just to touch on it, I’m not going to spend a lot of time on this today because we, we do this in other episodes and we’ll do this in a future one, which is capital gains and dividends for capital gains tax rates. Those are also income-based.

If you, as a married filing jointly in a couple earn less than $83,350 on your taxable income, you’re actually going to pay 0% in long-term cap. On the short-term side, you’re going to pay whatever your tax rate is. So again, if you made less than that, $83,000, for example, you’re going to still pay 12% on short term gains because that’s the taxable or the marginal rate you’re going to be in.

Once you go from $83,000, all the way up to $517,200, you’re actually at a 15% capital gains bracket. So, you’re going to be 15% on your capital gains for long-term gains into. On those gains, you also are going to pay something called a net investment income tax if you make over 250,000, that’s an additional three and change on that rate. So it gets you up to, you know, call it 18.9%.

Once you have over $517,000 roughly in income, then you do switch over to the 20% capital gains tax. And that’s on the long-term. On the married, that’s those are all married, filing jointly on the single one that you basically can split the 0% rate in half that gets you to $81,000 and change.

I’m [00:06:00] sorry, $41,675, literally right in half. But then they actually skew it a little bit in favor of those that file single. And your 15% rate goes from that $41,000 number all the way up to $460,000 roughly in income. So not half at all of what the married filing joint. You’re 20% rate though, does start at that $459,000 and change to hit 20%.

Those are for individuals one for a lot of our clients where we manage the states and trusts for them. They have a different capital gains tax rates for those that are either in a state that is filing or a Trust only have 0% capital gains up to $2,800. That’s 2,800. From 2,800 to 13,750 you’re at that 15% rate. And then above that, you’re already at $20. So very quickly you see that they have a much lower threshold to have a higher tax on those.

That’s enough about tax rates. And hopefully that kind of explained some of the relative terminology.

Deductions vs Credits

The other big one that I think is really important dive into is deductions versus credits.

A tax deduction is what you’re going to be able to do to bring your income down. Let’s say you have a $100,000 in income. A deduction of $20,000 means that you’re actually going to show $80,000 in income. They’re great. They help for a lot of different reasons and most things that we talk about with our high-income earners and executive clients have to do with the deductions because credits work differently.

Credits are actually a dollar-for-dollar credit against your tax bill. Let’s say that you owe, you have income of $500,000, and you’re going to owe $120,000 in taxes on it. If you can get a credit for $20,000, it would actually credit your tax bill down to a $100,000 dollars.

So, we love credits. But, credits are actually a lot harder to attain for high income earners because high-income earners phase out of almost all credits but not as many deductions. We are going to talk about a few strategies today that help out.

So hopefully that kind of allows you to see the differences in deductions and credits and why we’re so focused on your taxes, because it really impacts, you know, a pretty healthy number, 37%, on top of that is local and state and Medicare and social security tax and things. You can quickly see that you can get north of 50% taxes on the higher income levels.

Tax Legislation Outlook

So, what does that mean today? And then what does that mean moving forward?

Today the legislation, as it stands today, we’re now past the first of the year in 2022, the build back better bill did not end up passing. And so a lot of the things that we thought might be coming down the pipe are not how. What we did see is that a lot of the rates stayed roughly the same. A lot of the deductions stay the same and a lot of credit stayed the same, but it did give us a glimmer into kind of what they’re going after. As far as politicians are for where they are going to start kind of, changing the [00:09:00] tax code.

One piece is going to be some of the retirement plan contributions and conversion options. Others are going to be on the estate side of it. So just know that is probably coming again in some different iteration of that, but probably something similar. And coming down the pipe right now, the current laws are set to expire in 2025.

So, we did have a few more years of the current rates and current deductions and SALT limits and everything else that I’ll touch on in a second, still out there as far as limits go, we do expect them to change them between now and then. I would be surprised if they just continue letting them go for the foreseeable future after 2025. I do think we are going to have some type of plan done before then but this just gives you a little bit of an intro into taxes.

Tax Deductions

Again, what we are focusing here in this one is kind of some strategies and then looking at deductions verses credits and how we can kind of take the best of both worlds. Let’s first dive into deductions because frankly, those are ones that, that high income earners and a lot of our clients are able to get more of a than the credit.

When you look at deductions, there’s two different types of deductions that come in the form of taxes. One is something called above the line deductions that actually is going to lower your income before it hits what’s called your adjusted gross income, your AGI or your taxable income. Those are not interchangeable terms, but people do use them that way.

But your AGI, what that’s going to do is that’s going to take your income and then it’s going to deduct a handful of things off of it. The most common ones that are out there and the biggest ones kind of biggest bang for your buck for most of our clients is some type of retirement plan contribution.

Now, key here we are talking about pre-tax contributions to retirement plans. This is not a Roth contribution, as you probably know, Roth contributions are an after-tax contribution. So that is not an above the line deduction. You actually don’t get a deduction on it at all.

But the pre-tax contributions that can be a four pre-tax 401k, 403B, 457 Plan, a non-qualified deferred comp plan, a SEP, a SIMPLE, you name it. It’s a retirement plan where you were deducting those dollars from your paycheck before you pay taxes on them. So, it is a pre tax contribution. For most people who look at their W2, it actually doesn’t even show up on your W2 at the end of the year. These are not like you have to put in a byline for what you contributed to your retirement plan, but that is out there.

And that is kind of one of the biggest ones, especially with the non-qualified deductible contributions that we see in the plans that are out there for a lot of our high income earners or supplemental executive retirement plans, something along those lines. Those terminologies, where we have clients that are able to save $50,000 and $100,000 thousand dollars on top of their 401k contributions really drastically pulls their tax taxes down.

The other one is if you have a high deductible plan, the HSA contributions are a fantastic vehicle that we’ve seen a lot of clients use. And we’re big advocates of them. If you do have that high deductible plan, as long as you’re able to contribute, and then obviously invest them, pretend like that’s a retirement account for you, not just a, an account to use for your health care costs on a year to date.

The other one is student loan [00:12:00] interest. Now that one phases out at a healthy income number but not that high at about $170,000 as a married filing jointly individual. So, some people do receive the student loan interest, most of our clients not, but that is one that we see a lot.

The other one, again, not really for high income earners, but is going to be an IRA deduction. If you have a retirement plan yourself or your spouse, And you filed jointly. You can only make roughly $200,000 in income before that phase out occurs where you cannot get the deduction. But if you can, it’s a great deduction that $6,000 a year pretax that you can put into it and deduct off your income.

The other one that we see a lot is rental real estate losses. For those that have gone and purchased a place, gotten a mortgage on it, put some money into it and are still claiming a loss against the rent that they receive on it. They’re getting less income than what they’re spending on that property. They can take that as a loss against their income and deduct that.

Lastly, for those of you that are educators. So that is one that you can take a deduction for what your non-reimbursed expenses were. Examples are materials for your class or throw a party for your kids. My wife had those a lot when she was a high school English teacher, where we just had a lot of educator costs that she didn’t get reimbursed for, but she wanted to have materials for her kids that needed them.

That covers the above the line. These are really important because those deductions will then funnel into what you would then be able to receive as a credit because they look at your adjusted gross income.

After that though, if you look in and kind of follow the 1040, which is the form that all of this is based off when we talk about above the line or below the line when you look at your tax filing, there are a bunch of below the line deductions.

Now the most common thing that most people realize is when they passed the 2017 redo of our taxes the Jobs Act. That actually changed to make the standard deduction incredibly high. It’s now $25,100 for a married filing jointly for 2022 and half of that for a single. This increase allows you to have a standard deduction and not have to go through and itemize everything that you have now they did in the same time of doing that standard deduction increased to being so high. They did cap some of the things that a lot of our clients did have some pretty healthy deductions on in the past.

I’ll touch on those if you do itemize. So, the standard is your baseline. You can then itemize to see if you have a higher deduction that you can take below.

Itemized Deductions

The line what’s included in that is, is you have to look at the Schedule A and I’ll link to that in the show notes here ( https://www.irs.gov/pub/irs-pdf/f1040sa.pdf ) will give you kind of a breakdown.

Now, let’s cover the three most common that we have our clients use and we see.

First, taxes that you paid state and local taxes or SALT as they are called, you know, the acronym. Currently now that is limited to $10,000 on a high end that you can deduct, even if you pay $50,000 or $100,000 in state and local taxes, including real estate taxes, that cap that at $10,000

The other number that we see often is interest that you [00:15:00] pay on your mortgage. The Jobs Act in 2017, said that you can deduct interest on your mortgage up to $750,000 of mortgages. If you have a mortgage of 900,000, you’re deducting 75 divided by 90 on the home mortgage debt that you have.

And then the last one is the one that we’re going to touch on a lot, which is charitable donations.

Those that, that donate to charity do put them as a below the line deduction. I know in 2021 and I believe in 2022, they’re allowing you to put up to $300 above the line for everybody, no matter your income. But the charitable deduction is typically a below the line deduction. And so we’re going to talk about a really interesting strategy that we use for clients that has saved them just about $20,000 over a five-year period of time.

Now, that covers the deductions portion.

Tax Credits

I’m just going to really touch briefly on credits. Again, due to income limits, almost all of our clients phase out of all credits. When you look at credits, most of them phase out anywhere from a $100,000 to $250,000 in income.

The one that allows for a much larger income amount and still receive a credit is the recent child tax credit change. It’s a common one for most families. It’s a very large credit that you receive. And again, a credit meaning it is getting, you’re getting dollars put back against your taxes, they’re kind of paying your taxes for you. Think of it that way.

Each child tax credit is $3,600 for the year. And that phases out once you hit about $400,000 in married filing jointly or $200,000 in all other brackets or so head of household, single, married, filing separate it’s $200,000 that at that phase of that.

The other one’s like lifetime learner or savor or education, those are pretty much all phased out between call it a $100,000-180,000 in income. So if you want to look into those again, I’ll link up in the show notes to one of the ways that you can see all the different credits and the phase outs there. ( https://www.forbes.com/sites/ashleaebeling/2021/11/10/irs-announces-2022-tax-rates-standard-deduction-amounts-and-more/?sh=62de05064a3a )

But for most of our clients, with a phased out of that child tax credit for some of our clients, you know, younger executives that are doing well for themselves and have kids, those are still receiving those credits.

Have I bored you yet with kind of tax talk and what’s going on?

Tax Reduction strategies

Now let’s dive into kind of some strategy.

So far I’ve just tried to lay out kind of what all these things are that we’re talking about, how you can use them and what to think of. But when we look at clients that we serve and kind of think of it as that, the four strategies that we look at most.

First is going to be a retirement plan contribution side. When you do it properly, and if you have the options, we have clients that are able to save into a retirement plan pre-tax and reduce their overall tax that or the cost of putting dollars into that plan by north of 40%. Some, because if they live in New York and California, they’re actually reducing it north of 50%, meaning they put in $1 and they’re receiving back in about 50 cents on that dollar because of that’s their rate.

Again, go back to the beginning of the conversation or the podcast. And what we’re talking about is what tax rate are you taking a dollar out of? So if you have, as a married filing jointly, couple of you have over $650,000 in [00:18:00] income, every dollar that you were able to push into a pre-tax vehicle, whether that’s an HSA or a retirement plan, you are saving yourself just on the federal side, 37% because you’re not paying 37% on that. You’re then also saving it on the state and local. You’re also saving it on Medicare and social security, things like that. Again, if you’ve already hit that limit, then you’re over social security. The other thing that we’ve noticed is this substantially helps with credits and deductions.

Think about a married couple. They both work. They make $450,000 in income. Great income. Let’s say that we can actually have them save and they don’t have a high income or high lifestyle. And so we can actually put a hundred thousand to $150,000, that’s about 30% of their income.

It’s a large number, but the way that we can do that is through the supplemental executive retirement plans or plans through the, their 401k plans. We added up and we’re able to put away that amount of dollars. What that does is that takes them from what would have been the 35% bracket all the way down to the 32%, which doesn’t sound like that big of a savings.

But by doing that, we then can bring in other deductions. Or we can bring in some credits that were not available originally.

For that couple making $450,000 a year, they would have phased out of all the child tax credits, which is $3,600 per child. I use myself an example. I have three kids, all of them would, if I had income less than that would have been fit would have received or given us the credit.

So those three kids, $3,600. That’s a lot of taxes that I would save, if I could get those. But if I had an income too high, I don’t.

So by doing that, by pushing the money into retirement plans, we get them back under that $400,000 limit and then all of a sudden that tax credit comes in again, a credit not deduction, it’s a credit.

So for them, for our family, it’s over $10,000 in taxes that we do not pay because of the child tax credit.

I will touch on this because this has been something that we’ve seen a lot recently where, people. All of a sudden had a Roth 401k or four, three be available through their employer. And they’ve heard so much about it over the years about how they are over the income limit.

So they can’t contribute to Roths. And all of a sudden they have this option available. So they take advantage of it. They decide “I’m not going to put money into my pre-tax 401k or 403b, I’m instead going to now put it into my Roth option.” Please look at what your tax bracket is today and where you believe or where you think you’re going to be in the.

This is a big mistake that we’ve seen a lot of individuals make, where they look at their taxes and they just say, “Hey, I just want to push money into Roths. You know, I make $350,000. I’m just going to push it all into a Roth. And I understand, but you’re in the 33% tax bracket. Why not get the deduction today?”

If in five years from now, you’re going to retire. And all of a sudden you can choose how much you show an income until you have to show them out because of your. There’s a lot of reasons why this choice is fair. If you want to make the Roth and we can talk through kind of why that would be the case.[00:21:00]

Please analyze your kind of lifetime tax rates and play with the numbers and, or bring in an advisor to kind of figure out when you should be showing income or not. And using those Roth or pre-tax options there. Now, one thing I’m just going to touch on is the build back better plan gave kind of a big clue that they are going to start looking into Roth conversions as I’m kind of phasing them out or not allowing them for high income earners.

It doesn’t mean that once you’re retired, you cannot do Roth conversions. They did an income, reason why you can’t do it at, I think it was over 400,000, as far as income. We’re not allowing Roth conversions, but if you’re retired and you’re taking a required distribution or social security, or you name it, you might be under that limit and still be able to do convert.

I just want to bring it up to the fact that if you have post-tax IRAs and you can convert them, you might want to start doing that sooner rather than later, just because of this kind of big clue that they gave in that bill that ended up not getting passed. So tstrategy number one is take advantage and calculate what you should be putting into your retirement plan contributions, take advantage of deferred comp plans and everything else to try and lower your brackets today to then qualify for other deductions and credits.

The other one that we’ll touch on a lot, and I think is one of the most impactful ones, is charitable donations or charitable giving. The majority of our clients have causes and organizations that they care deeply about. And thus, they want to give financially towards. Now, rather than just doing it haphazardly, we recommend putting a structure and a plan into place for those gifts. If you can donate appreciated stock instead of cash, or as you get older, you can look into something called a qualified charitable donation where you actually take it directly out of your IRA and directly to a charity, reduces your RMD, and also then never shows up as income.

Charitable donations are typically a below the line deduction. If you can do a QCD, a qualified charitable donation, it’s an above the line in a way deduction because it comes off the top of your income before you even get to your taxable rates.

Now, if you’re making donations, one of the things that we’ve seen that is key with charitable donations and that we do a lot of planning on for clients is choosing when and how much to give in a calendar year. Reason why that’s important is you can use some great vehicles like you’ve probably heard about them or read about them, a donor advised fund or something like that, where you can make a donation in this calendar year for tax reasons, but then not actually give it to the charity until future.

Now this makes sense. And if you have the option and you have the balance sheet to do it, maybe donations in alternative years or choosing which years to do it based on other income or other kind of scenarios that you have in your situation, you can substantially reduce your taxes.

Now we’ve seen this where we have a simple example here.

I just did this quick math for another client so I thought it would be a good one to you. If done correctly, you can reduce your lifetime taxes. And so we’re just [00:24:00] gonna do the very simple example of assuming you have state and local taxes over 10,000, but your cap is $10,000, and you want to make, call it a $30,000 charitable donation.

So in total that’s $40,000 that you’d be taken on an itemized, donate a deduction. Let’s assume that you don’t have a mortgage or any other deductions, but just for the sake of conversation, we’re going to assume that those are your only two itemized deductions you could do.

If over a six year period, you just do it straight $10,000 in your SALT, $30,000 for your charitable donations, you’re going to have deductions worth $240,000 over six years. Very simple, $40,000 times 6, is $240,000 into deductions.

Now let’s assume that we just literally skip the charitable donations and lump them together every other year. The first year we do $60,000 in donations, plus our $10,000 SALT that gets us to $70,000 itemized for the year. We then have the standard deduction, $24,000, the next year and skip the donation. Okay. It’s actually up to $25,000, but when I did this, it was off 2021, which is $24,000 then. Then you do it again, $70,000 in itemized and then $24,000 standard and then $70k, and then $24k… you see it, do that for six years.

I did six because then it’s even on a amounts that you itemized versus standard comes out to $280,000 in deductions.

You just deducted $42,000 more off your taxes than you would have if you had just done a straight.

At roughly a 45% marginal rate. So let’s say that you have the 37% tax rate, you make over $650,000 as a family. And then you live in New Jersey or you live in New York, or you live in somewhere where there’s a state income tax. That’s where I got that 45% rate.

That’s a savings of almost $20,000. It’s $18,900 in savings on taxes. You’ve done nothing materially different. You haven’t changed the way that your income shows or savings, just done a better job managing taxes. You can do even better by really ramping that up and kind of pushing more towards charities in certain years where you have higher income to lower your marginal rate.

But what that will do is that could push you to qualify for other credits and deductions, which I don’t even talk about in here, but that’s just a pure you know, kind of using the code to your advantage.

Last two strategies.

One is just on a mortgage interest deduction. For many of this deduction, along with the charitable deduction is going to push them over the standard.

There’s no income limit to the amount of income that you can earn and still take the mortgage deduction. So for a lot of clients, I know it’s a low interest rate environment right now, but they’re able to take $15-20,000 in mortgage deductions that, that plus the salt tax gets them over and then they can itemize everything. Then every dollar of charitable donations, every health expense that they can donate or deduct anything that they conduct in the put in the item actually counts because up to 24 now, 25,000, it, you really don’t get the deduction because it’s a standard.

The standard gets you to 25 and with salt tax being capped at 10, you really have to have 15 plus thousand dollars in mortgage or charities that is [00:27:00] going to push you over that itemized limit.

So just something to be aware of, which is included in this third big one, if you will, for strategies is use mortgages to your advantage, especially when it comes to tax. Your mortgage deduction. Again, if you think of that 37% bracket, you know, it can save you 37 cents on every dollar that you pay in interest there.

The last one is going to be on taxes for your investments. I call it tax aware, investing.

There are a couple of categories for this, one tax loss harvesting. You’ve probably read about that. It’s when you actually sell an asset solely for the losses on it, you can then buy it back 60 days later, but you’re going to sell an asset to get the losses in account.

The other one is if you have a bunch of losses, do something called tax gain harvesting. Because you can only deduct $3,000 in losses in a calendar year, or why not just go and take some gains off the table, maybe an asset that you held for a long time, but you really don’t want to own as much of it anymore.

The other one is mutual funds versus exchange traded funds or ETFs. If you look into it and you do just a little bit of research on it. You’re going to see that the way the tax code helps ETFs or exchange traded funds is kind of remarkable. You know, they don’t have to pay out capital gains as mutual funds do.

And so with some clients, when you’re adding money to accounts, just be very smart about the type of investment you’re adding to. You can look up and see what their capital gains distribution is going to be.

And we’ve had some clients. really badly shocked from before working with us what their capital gains tax was on a mutual fund that really didn’t earn a whole lot, but the fund turned over and so they kicked out a capital gain for them.

It’s a, it’s a very not good surprise. The other reason to be aware of kind of tax aware investing is this Net Investment Income Tax. You are taxed on top of your capital gains four and it’s 3.8% that you’re taxed on top of what your gains would be for investment income. Uh, it’s just, it’s something that tacked on a couple of years back.

And so, it’s frustrating. It’s a, it’s a flat line. Once you’re over 250,000 in income, it starts hitting.

The last two things I’ll touch on there is short-term versus long-term capital gains rates. For an individual that makes $650,000 as a, as a couple, you’re going to pay 37% on any short-term capital gain, if it’s a long-term you’re going to pay 20%.

Yeah. I think everyone would rather choose 20% tax versus 37%. So just be aware of short-term versus long-term.

And the last one is where you hold your assets. Would you rather hold a bond that pays off consistent dividends in a taxable account or a taxable account. You are going to get taxed on that dividend payment might be a better tax rate and you might get charged at 20% versus, um, uh, eventually taking money out of your IRA at whatever rate that would be.

From a tax perspective, it’s eating up your return by having it in your, um, in your taxable account, in your IRA. You’re not going to be taxed. Now the argument can be had, which one do you want to gain more? Or do you want your IRA to gain more or your investment account to gain more?

So just know and have a strategy is my point.

There’s not one exactly right answer. Cause it is different for [00:30:00] everybody based on your tax rates today, tax rates in the future and what those dollars are used for, but just where you hold your investments in which type of account from a tax perspective matters. I hope this was really helpful, a little longer than I expected it to be, but a lot to talk about.

So, the biggest tax reduction strategies, as I said:

- Make the right choices on your retirement plans.

- Lump your charitable donations if you can, or just have a plan in place on your goals.

- Take care of that mortgage deduction or other types of deductions that can then make it so you can itemize in years and moving forward.

- Have a tax-aware investing strategy.

That’s it. I hope that was really helpful.

We’d love to hear what questions you have as a follow-up to this or anything else that we can touch on in these talks. We really appreciate your time. Thanks so much. Take care.