12 Oct Podcast: Equity Compensation Strategies for Hedging, Diversification, and Tax Minimization

In today’s episode Nicholas Olesen, CFP®, CPWA® continues our short podcast series on equity compensation, covering what to do once you have received them or are about to receive them. If you missed the first one, you can go listen here.

During the episode Nicholas shares:

- The main objectives of equity compensation

- How quickly investors can become concentrated in employer stock

- What is a “cashless exercise”

- Best way to diversify without creating a big tax bill

- How to reduce the tax burden of equity compensation

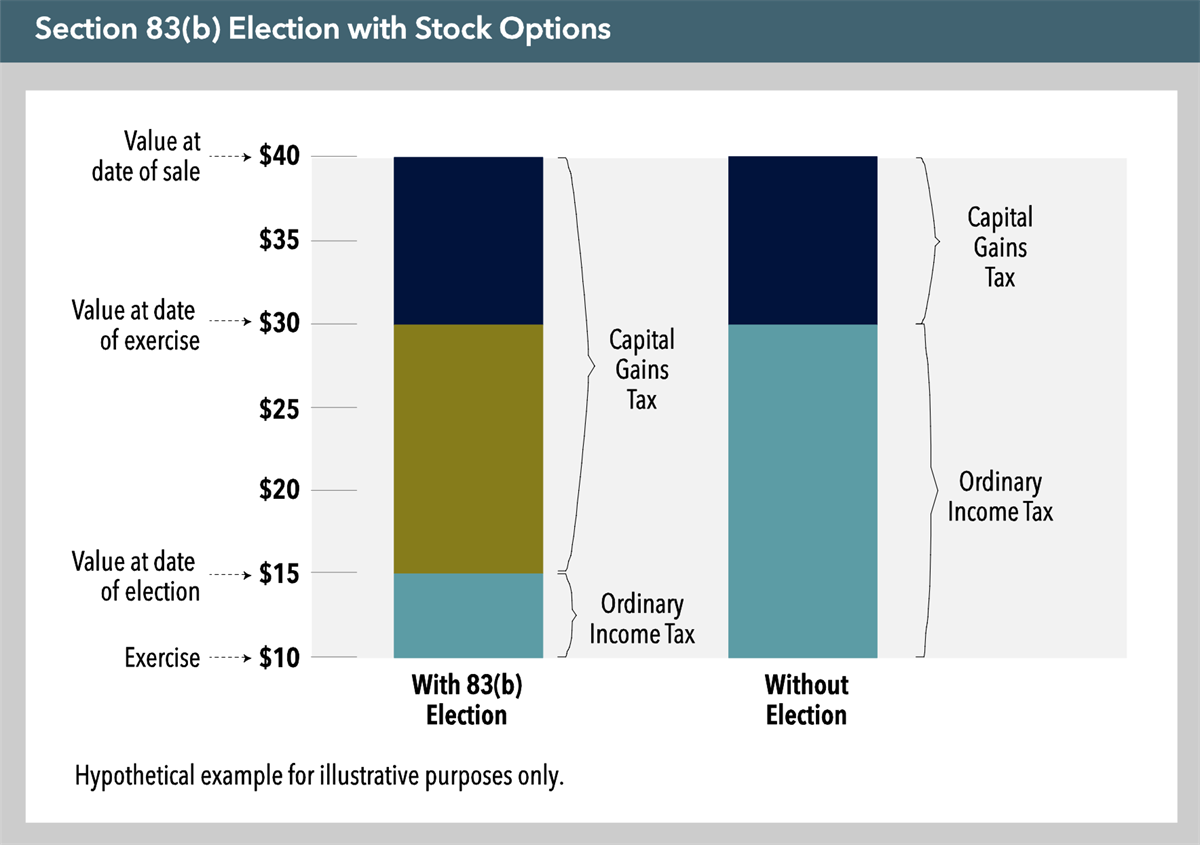

- What is an 83(b) election and when should you use it

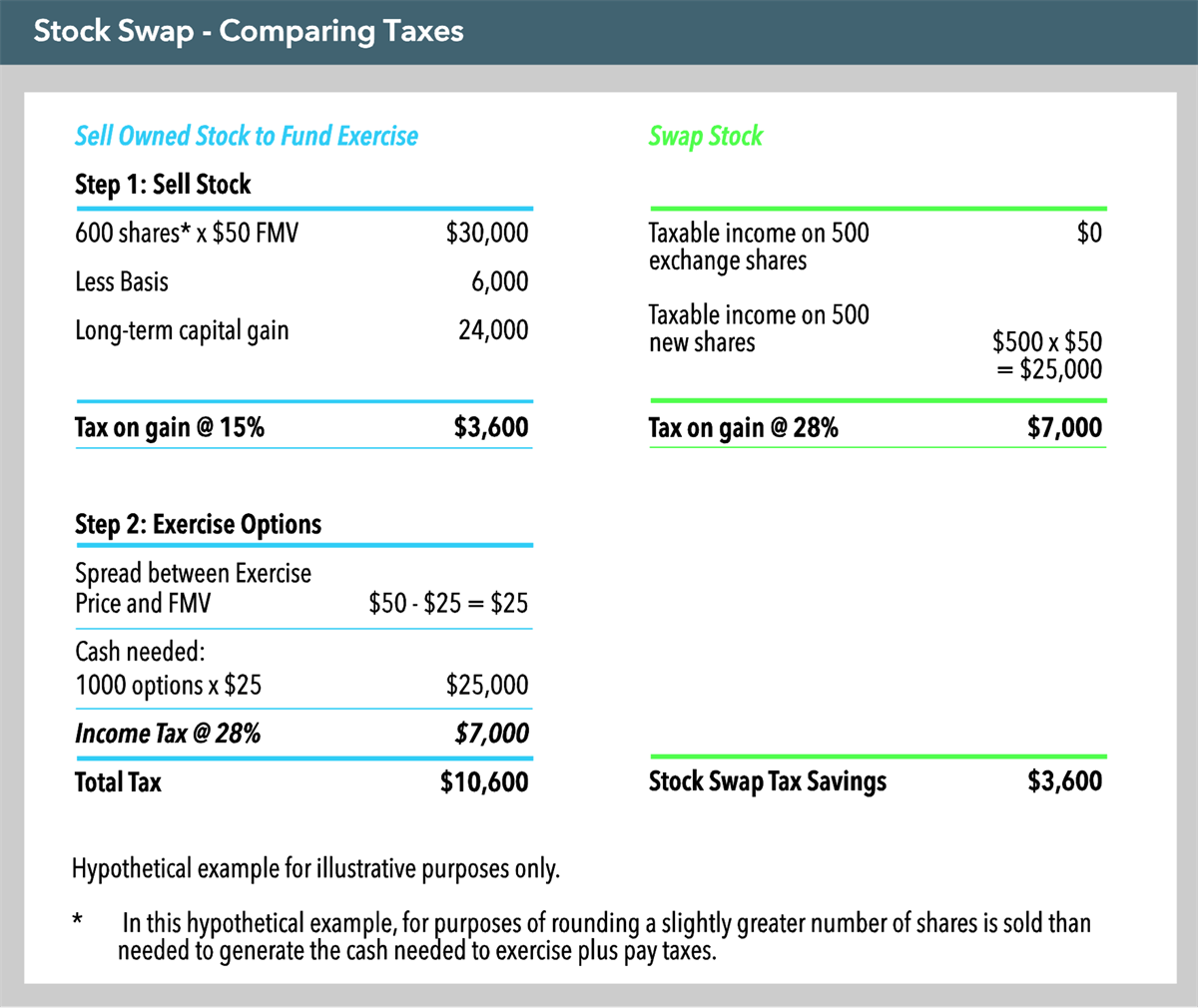

- How to use stock you own to exercise an option and then double up on that option

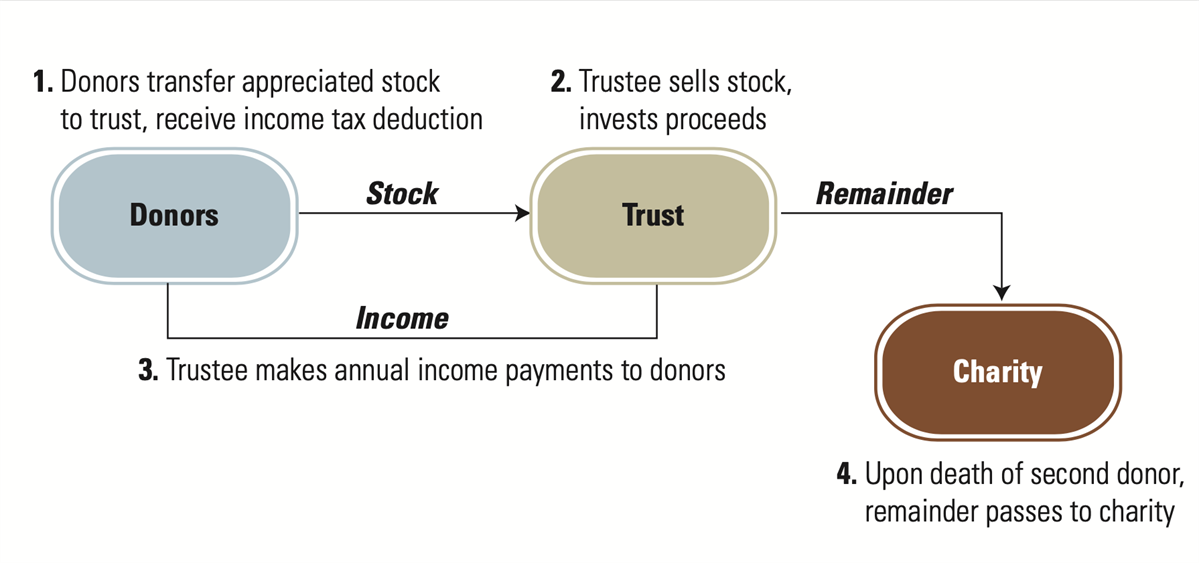

- When to use Charitable Trusts

- The best hedging strategies for different types of equity compensation

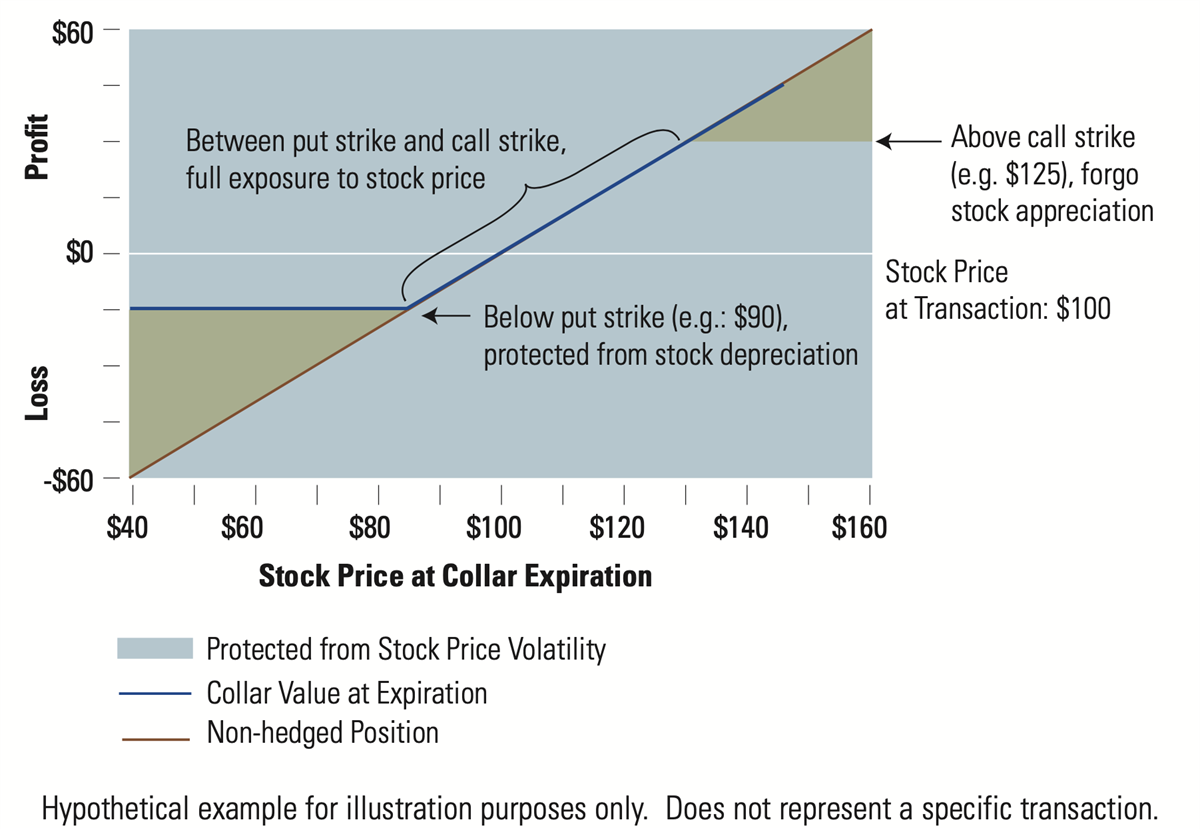

- The benefit of a “zero premium collar” strategy

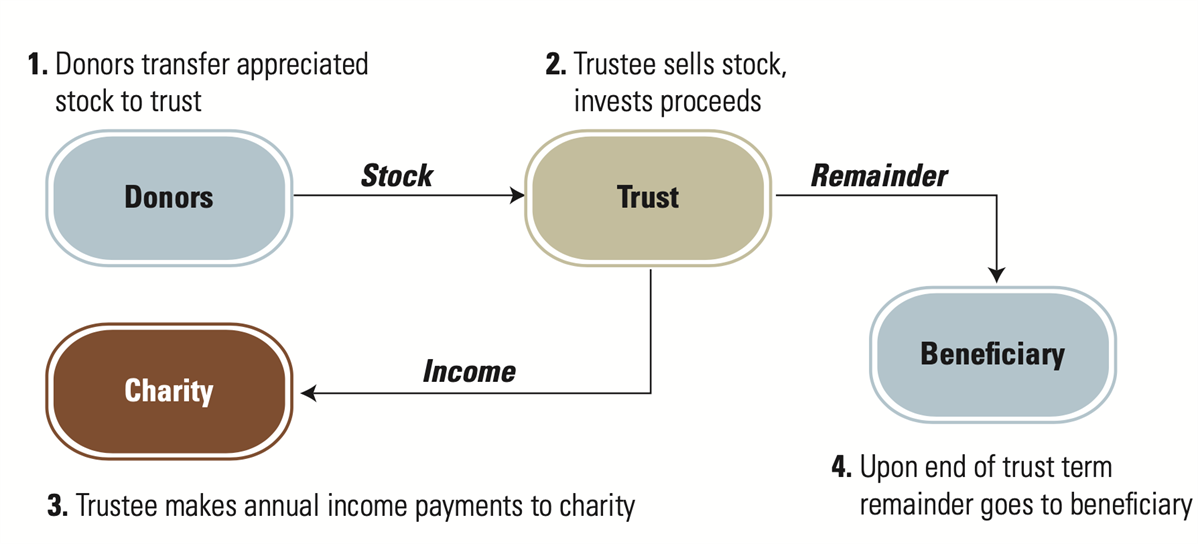

Here are a few charts that can help clarify the topics discussed in the podcast:

Zero Premium Collar:

Charitable Remainder Trust

Charitable Lead Trust

We hope this was a useful guide. As always, please consult your financial advisor and/or accountant before using any of these strategies.

Please send in feedback and any topic or questions you would like us to cover. Email us here. [email protected]