15 Jun Are Forecasted Earnings Too Optimistic?

While the economic consensus has shifted away from anticipating a “V-shaped” economic recovery, Wall Street’s analysts do not appear to share the same sentiment for the earnings of S&P 500 companies, as evidenced by their forecasts.

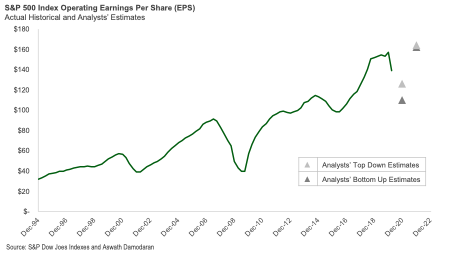

The chart below presents the S&P 500 Index’s historical operating earnings per share on a rolling one-year basis through the first quarter of 2020 as well as the analysts top down and bottom up estimates for 2020 and 2021. On a top down basis, analysts are projecting that earnings will decline by 19.9% in 2020 before rebounding sharply in 2021 to new all-time highs. Meantime, on a bottom up basis (which are typically biased lower than top down projections), analysts are forecasting a decline of 30.2% in 2020 before sharply rebounding in 2021.

Based on the economic damage we’ve see wrought by Covid-19 thus far, Wall Street’s consensus earnings estimates for 2020 appear to be a bit too optimistic when compared to the earnings experiences of the aftermath of the Dot Com Crash and the Global Financial Crisis

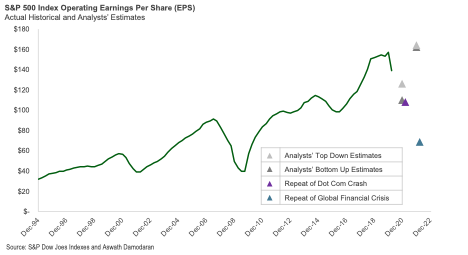

Consider that in the early 2000s following the bursting of the tech bubble, earnings dropped 31.6% over the course of five quarters. Meantime, during the GFC, earnings collapsed by 56.7% from their all-time high over the course of nine quarters from peak to trough. During the recovery from the trough, it took earnings approximately two years to achieve a new all-time high in trailing one-year earnings during both episodes.

To provide additional perspective on how the current consensus expectations compare to the full peak-to-trough decline on the past two episodes, the chart below plots how earnings would evolve if we were to experience a repeat of the Dot Com Crash or the GFC from a peak-to-trough earnings perspective. Presented in this manner, it certainly appears as though Wall Street’s current expectations may be a bit too optimistic and may be primed for downward revisions in the months ahead. I continue to believe a modest defensive posturing towards stocks is warranted in the current environment. My view is bolstered further by the emerging signs of building speculative excesses in the markets (see the trading frenzy among retail investors, the speculation in stocks of bankrupt companies, IPOs and companies without revenue, as some of many examples) which have had a way of reversing in the past.

This guidance should not be interpreted as an attempt to predict the short-term direction of the market as I view such an exercise to be a fool’s errand. Nevertheless, I believe an emphasis on defense in prudent in the current environment where the risks to the downside appear to outnumber those to the upside. Such a positioning may present opportunities to turn more offensive during a renewed bout of market volatility in future should one occur.

Important Disclosures

Kathmere Capital Management (Kathmere) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Kathmere and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Kathmere cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.