28 Apr Bond Portfolio Repositioning: Opportunities in Fixed Income

Executive summary

- Recent developments within the fixed income markets present an opportunity for us to reposition our clients’ bond portfolios to capitalize on what we believe to be compelling opportunities.

- We are repositioning applicable client fixed income portfolios to a barbell approach comprised of a combination of an ultra-short duration taxable investment-grade strategy paired with an allocation to short-term high yield corporate bonds.

- The allocation to high yield bonds will vary as a percentage of the overall fixed income portfolio across model portfolios, such that more conservatively allocated portfolios will have a smaller relative allocation to high yield than will more aggressively positioned, growth-oriented portfolios.*

As the COVID-19 coronavirus expanded across the globe during recent months, we’ve witnessed some dramatic moves in the financial markets. Clients are no doubt aware of the historically unusual 5-10% swings daily swings—both negative and positive—that have occurred in the equity markets. While the equity markets tend to gain the lion’s share of attention among investors, the fixed income markets have also seen some significant developments that we’ve been monitoring and now believe warrant a response in terms of repositioning client portfolios. Below we briefly summarize these recent developments and then describe the opportunity we see for investors ahead and how we intend to reposition client portfolios, where appropriate.

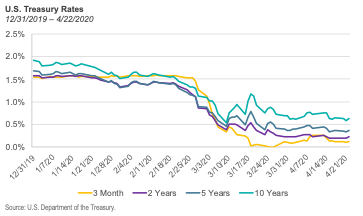

The equity market sell-off that began in mid-February triggered a flight to safety in financial markets which saw investors broadly move out of risk-oriented assets such as stocks and credit strategies and into perceived safe-havens such as U.S. Treasury bonds. The effect of these moves what to drive U.S. Treasury yields to historically low levels. The chart below demonstrates how yields have moved sharply lower in 2020. The 10-Year U.S. Treasury yield, which began the year at 1.92%, fell to just 0.63% as of April 22. Meantime, the 2-Year yield declined from just 1.58% to a barely positive 0.22%. Extremely low rates such as these make Treasuries unattractive in our perspective on the basis of their forward-looking risk and return potential.

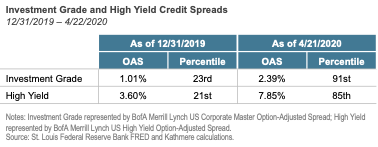

Amid the flight to safety that saw Treasury yields plummet to historically low levels, credit-sensitive investment-grade and high-yield bonds sold off dramatically relative to Treasuries. Credit spreads, which measure the additional compensation investors require to invest in bonds with credit risk relative to Treasuries of the same maturity, have widened materially during the crisis to levels last seen during the Global Financial Crisis. Spreads on both investment-grade and high yield corporate bonds have gone from being richly priced at the end of 2019 to being priced at historically attractive levels as of today, as is revealed in the table below.

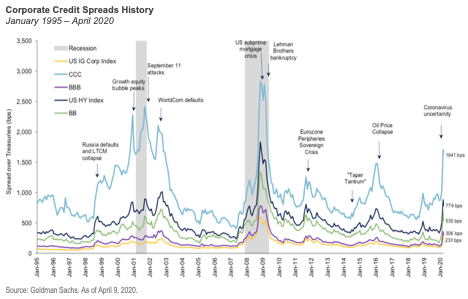

The chart below, from Goldman Sachs, presents today’s spread levels in historical context. The chart shows that spreads in both markets are at levels only seen in the aftermath of the credit build up during the tech boom and the ensuing corporate accounting scandals as well as during the financial crisis. Both episodes witnessed tremendous short-term stress within credit markets which ultimately dissipated and saw spreads return to more normal levels.

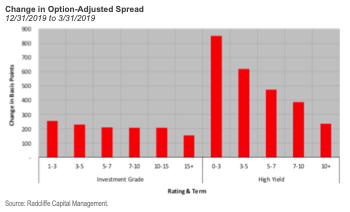

The recent spread widening has been most significant in short-term bonds as is revealed in the chart below from Radcliffe Capital Management. We attribute this phenomenon largely to technical factors resulting from the fact the short-term bonds are generally more liquid and thus easier to sell during times of stress than their longer-dated peers. Accordingly, during a rush for liquidity like we experienced in March, when investors sold whatever they could most easily sell (short-term bond) it resulted in tremendous price pressure and ultimately spread widening in the short-term segment. We believe this development will ultimately prove to be transitory and creates opportunity within the short-duration segment of the investment grade and high yield corporate bond markets.

Of course, it’s important to form a view on what’s driving this spread widening. If it’s the result of rational expectations for increased defaults in the future which would lead to credit losses for bond holders, this wide spreads in and of themselves would not make credit-sensitive bonds a compelling investment opportunity. If, on the other hand, the spread widening is a result of a widespread increase in risk aversion which has led to indiscriminate selling of risky assets that will eventually prove to be temporary when the worst of the crisis is behind us, this would make credit bonds highly attractive for investors with the fortitude and patience to look beyond the current crisis to a more normal investing environment.

While we certainly expect an uptick in defaults in both the investment grade and high yield corporate bond markets in the immediate term, our assessment of the available research leads us to conclude that credit spreads in both markets are painting an overly pessimistic default picture. In other words, we believe the market is pricing in default levels that are in excess of what we believe is likely to occur which presents an opportunity to capture excess returns.

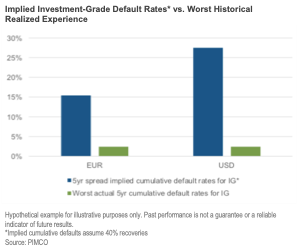

The chart below, which comes from PIMCO, shows that investment grade credit spreads at the end of March implied default rates in excess of 15% and 25% in Europe and the U.S., respectively, over the next 5 years, assuming historical recovery rates on defaulted bonds. These implied default rates far exceed the worst actual 5-year cumulative default experience in both markets by a significant margin.

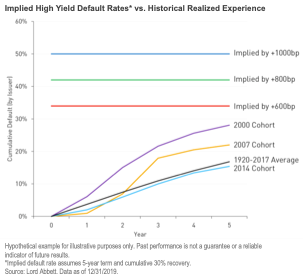

Lord Abbett conducted a similar analysis on the high yield market which strongly suggests that the default rates implied in high yield spreads are likely too pessimistic in that they too are pricing in a default scenario far worse than has ever been experienced historically.

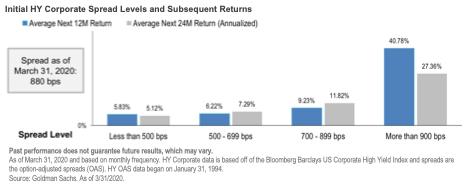

Lastly, we look to an analysis from Goldman Sachs which reveals that history suggests a high probability of strong returns from high yield bonds given the current level of spreads. Specifically, the analysis, presented below, shows that high yield has historically delivered attractive returns when starting with initial yields comparable to those that prevail today.

Our analysis of the available data and research has led us to conclude that short-duration investment grade and high yield corporate bonds are priced attractively and present a compelling opportunity for our clients. Accordingly, we are repositioning our clients’ bond holdings to take advantage of this potential opportunity. Specifically, within appropriate portfolios, we are repositioning client bond holdings into a barbell combination of an ultra-short duration taxable investment grade credit strategy paired with an allocation to a short-term high yield corporate bond strategy. The allocation to high yield bonds varies across client portfolios of differing total risk tolerances as percentage of the fixed income portfolio such that more conservatively allocated portfolios will have a small relative to allocation to high yield than will more aggressively positioned, growth-oriented portfolios.

Important Disclosures

Kathmere Capital Management (Kathmere) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Kathmere and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Kathmere cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise and bonds are subject to availability and change in price. Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors. Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Federally tax-free but other state and local taxes may apply.

The graphs used throughout are not intended to represent actual portfolio returns or any strategy currently or previously offered by Kathmere. The graphs are for illustrative and educational purposes only.

*The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Kathmere Capital Management. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these types of securities were or will be profitable. There is no assurance that securities discussed in this article have been purchased or remain in the portfolio or that securities sold have not been repurchased. It should not be assumed that any change in investments, discussed in this article have been applied to your account. Please contact your investment adviser to discuss your account in detail.