19 Apr Two Realities

A prevailing theme in market commentary these days is the apparent disconnect between the current state of the U.S. economy, which is digging itself out the deep, yet likely short-lived contraction caused by Covid-19, and the stock market, which has been on a historic run over the last three plus months. Many analysts and pundits have commented how the stock market appears to be untethered from reality.

I believe this view is so widely held is because for many of us, our perspective on the state of the economy is largely tied to what’s highly visible and therefore more personal and “real.” Thus, when we routinely see highly publicized reports of national retailers filing for bankruptcy, local shops and restaurants closed up and know of family and friends that have lost their jobs, we very naturally extend these observations to conclude that the economy is in tatters and thus, the stock market should be as well.

To understand where this logic breaks down, we must first recognize that when we talk about the performance of the broad U.S. stock market as measured by a popular, well-known index like the S&P 500 Index, we are referencing a market-cap weighted index wherein a given company’s weighting in the index is determined by its total market capitalization (i.e., larger companies have larger weights in the index than do smaller ones, as measured by market capitalization).

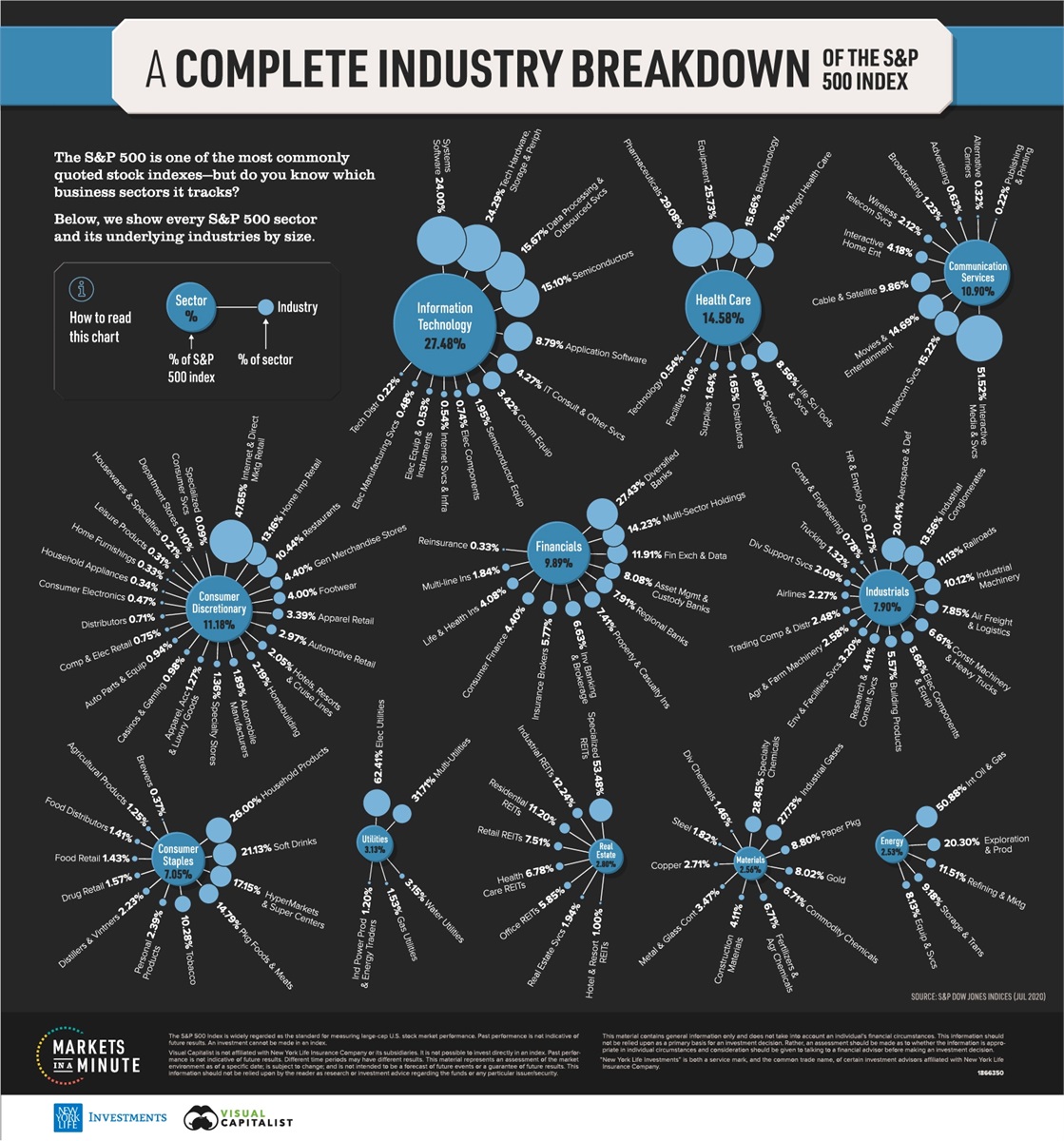

One of my favorite sites, Visual Capitalist, recently put out a fantastic infographic, presented below, that breaks down the composition of the S&P 500 into sectors as well as each sector’s underlying industries according to their respective market capitalizations. This infographic goes a long way toward explaining the apparent disconnect between the state of the economy and the recent strength of the stock market.

The reality of the situation today is that many of the highly visible companies, industries and sectors that are truly struggling in the current environment and that we are all so familiar with comprise a very small fraction of the overall market. Accordingly, their contribution to the performance of the overall market (both good and bad) is comparatively limited. The reality is that the aggregate market is simply not that susceptible to the fate of many of these highly visible and economically vulnerable industries.

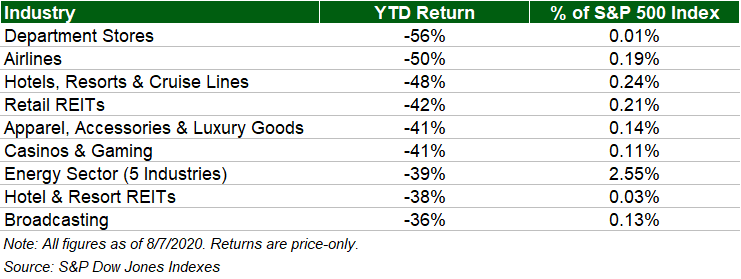

Take for instance, the table below which presents a selection of the worst performing industries this calendar year and their weight in the S&P 500 (both figures as of August 7) according to data from S&P Dow Jones Indexes:

All of the industries above are highly visible and recognizable and have been to focus of much press attention in recent months. As we can see, they’ve performed quite poorly—likely roughly in line with how many of us would’ve expected them to perform in the current environment. In aggregate, however, they comprise less than 4% of the broader market. Thus, while these industries—and the individual companies that comprise them—may be integral to the overall economy, are highly visible and may be large employers, they simply are not that significant to the overall performance of the market.

Meantime, each of the three largest stocks in the index—Apple, Microsoft and Amazon—individually comprise more than 4% of the index. In total, the top 10 stocks in the index comprise just shy of 30% of the market. Many of these companies are performing quite well on a fundamental basis (i.e., are growing revenues and earnings) in the current environment and have seen their share prices bid up in a reflection of this reality. This in turn has driven the overall market higher.

Ultimately, I recognize that a legitimate case can be made that the market may be overly emphasizing the positives and downplaying the potential negative developments on the horizon to the extent that the balance of risks is tilted toward the downside and that as a result, a modestly defensive positioning may be warranted in the current environment. That is a topic for another commentary, however. The point here is simply that the markets are by no means “detached from reality” as many commentators have suggested and that two realities can and do exist.

Sources

Visual Capitalist (https://advisor.visualcapitalist.com/sp-500-sectors-and-industries/)

S&P Dow Jones Indexes (https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview)

Important Disclosures

Kathmere Capital Management (Kathmere) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Kathmere and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Kathmere cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.