06 Feb Some Perspective on the Potential Implications of Coronavirus for Investors

Volatility has noticeably returned to financial markets recently on concerns of the human and economic impact of the coronavirus, a respiratory illness first identified in Wuhan, China. While the headlines have certainly been worrying, and no loss of human life is insignificant, I believe it’s imperative for investors to put the still rapidly developing situation into perspective prior to making any reactionary moves in their portfolios.

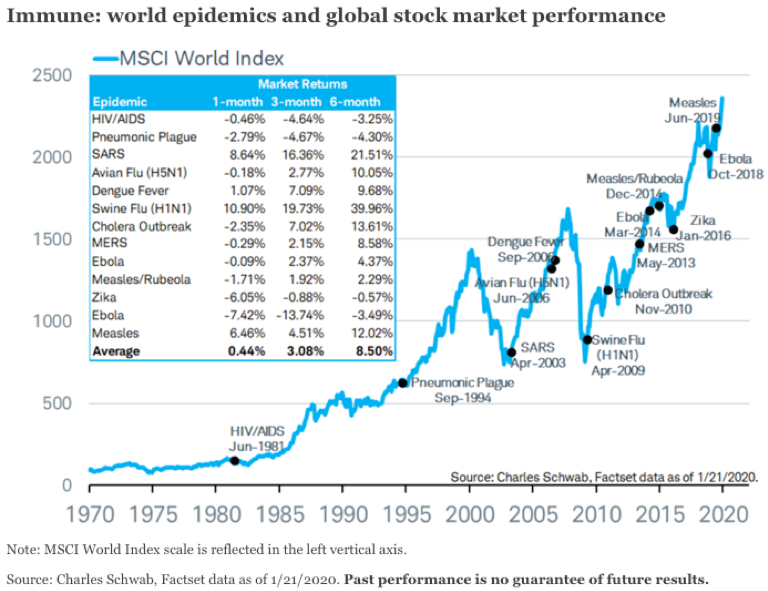

Pandemics periodically grab the attention of markets and impact economic growth and contribute to market volatility. The chart below from Charles Schwab’s research team shows that historically the global economy and markets have been relatively immune to the effects of past viral outbreaks—including ones that occurred during periods of robust as well as comparatively weak economic growth.

The chart demonstrates that during past global health scares we’ve seen an immediate drop in stocks as concerns about the potential epidemic escalated which has ultimately been proved to be short-lived as the initial drop has been followed by a rebound in economic activity and a market recovery as outbreak has been contained and fears dissipated.

Many analysts and commentators have noted several similarities between today’s coronavirus and the outbreak of the SARS virus (also a coronavirus) that began in China in late 2002 and gained worldwide attention in early 2003. As such, in the sections below I examine the SARS outbreak in additional detail to see if the past provides any clues as to what to expect this time around.

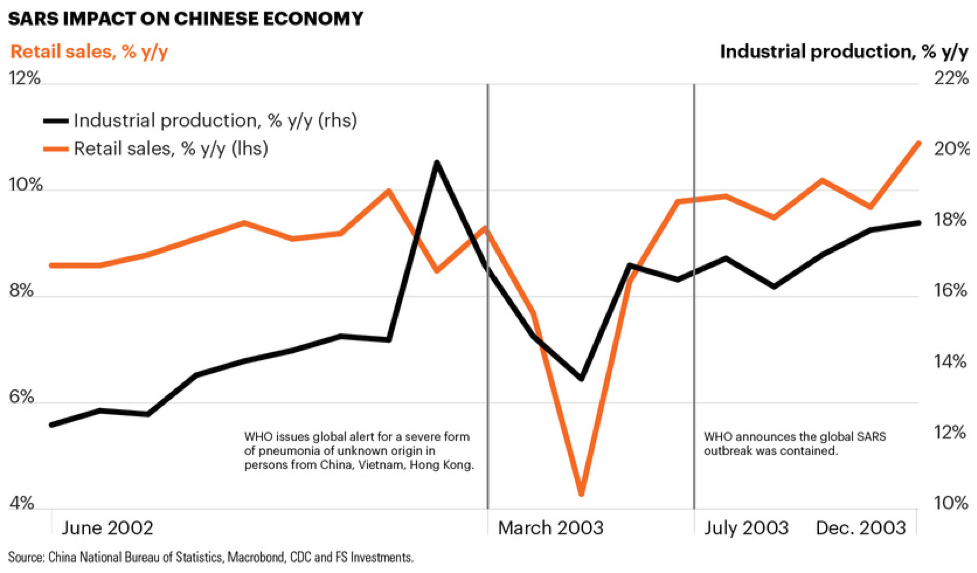

The chart below, from FS Investments, demonstrates that the SARS outbreak appears to have had a negative, albeit temporary, impact on both retail sales and industrial production figures in the Chinese economy. Economists at Vanguard estimate that SARS ultimately knocked two percentage points off of China’s GDP growth in the second quarter of 2003. According to Schwab, the World Bank estimated that SARS reduced global GDP by $33 billion. And while that may seem like a large figure—and to be sure, $33 billion is—perhaps it isn’t quite that large when considered relative to the fact that the seasonal flu is estimated to cost $10 billion in lost output per year, in the U.S. alone according to figures from the Department of Health and Human Services cited in the Schwab report.

The chart below from Glenmede suggests that the SARS outbreak contributed to market volatility both in China and here in the U.S. as markets participants reacted to new developments. We can see that SARS outbreak appears to have added briefly to the pressures on global stock markets in early 2003 as the economy was emerging from recession and wary of the implications of the ongoing invasion of Iraq. However, as the virus and its impact was contained and fears dissipated, economic activity rebounded and the market recovered—the Chinese economy experienced an acceleration in full-year GDP growth in 2003 to 10.0% vs. 9.1% in 2002 and the S&P 500 Index finished the year up nearly 29% on a total return basis.

Looking forward, a base case would be to assume that the current coronavirus is likely to impact the global economy and markets similarly to SARS. Of course, we need to be careful about drawing too many conclusions simply because the similarity between the two viruses. Notably, there are a few reasons to believe the coronavirus’ impact may be more significant than that of SARS:

- The outbreak coincides with the Lunar New Year in China which is the most important holiday for travel and consumption in the country.

- The rate of contagion appears to be higher for the coronavirus than it was for SARS (i.e., the virus is spreading faster).

- The Chinese economy is a larger and more globally interconnected today than it was in 2003.

- The global economy may be more vulnerable to slipping into recession as a result of last year’s slowing of global growth.

On the other hand, there are multiple reasons to believe the impact may be less severe:

- China as a country is far wealthier today and better prepared to deal with viral outbreaks than it was nearly two decades ago—China’s economy is more than three times larger today than in 2002 as a result 15+ years of strong growth.

- The Chinese government’s response has been quicker, more serious and better-coordinated with international public health agencies and foreign countries than it was during the early stages of the SARS outbreak.

- The coronavirus is less virulent than SARS which killed approximately 10 percent of those infected vs. only 2-3 percent of those infected with coronavirus (for comparison, seasonal flu has a mortality rate of less than 0.1 percent but because it infects so many people, approximately 400,000 people die of the flue worldwide each year).

Ultimately, it’s impossible to predict the extent to which the coronavirus will spread and what its toll on human life and its economic impact will be. It’s certainly possible that the virus becomes a major pandemic that will infect and kill millions around the world and have devastating human and economic impact. It’s also eminently possible that the rapid and determined responses of governments and global health organizations will be effective at stemming the spread of the virus and developing a vaccine. In the immediate, near-term, I believe the situation is likely to get worse before it gets better and that we’re likely to see the number of confirmed cases continue to grow and fear-driven news coverage to persist.

Long-term investors should recognize, however, that the global economy and markets have historically been resilient in the face of past epidemics. Historical experience and evidence have taught us that making knee-jerk reactions to long-term portfolios based on fear and gut-instinct tend to be value-destroying rather than value-additive. Investors holding a well-diversified portfolio that is tailored to their individual goals and risk tolerance likely have little need to take action today.

Sources:

“How Dangerous is the Coronavirus and How Does it Spread?” Financial Times; January 31, 2020

“Macro Matters: Economic and Financial Market Impact of Wuhan Coronavirus” FS Investments; January 27, 2020.

“Glenmede Investment Strategy Insights: Pandemic Fears of Wuhan Coronavirus” Glenmede; January 28, 2020.

“Will the Coronavirus Outbreak Lead to a Market Breakdown?” Charles Schwab; January 31, 2020.

World Bank data found at https://data.worldbank.org/

Important Disclosures

Kathmere Capital Management (Kathmere) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Kathmere and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Kathmere cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results.

S&P 500: Standard & Poor’s (S&P) 500 Index. The S&P 500 Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad U.S. economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI World Index: MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries.