18 Nov Vaccines, Rising Cases and Internal Market Rotation

Traders and long-term investors alike have certainly had a lot to process thus far in November. In addition to the 2020 Election (the implications of which we discussed in a recent podcast) the investment community has been contending with some significant developments on the Covid-19 front. Most notably, on the one hand, market participants have been faced with negative developments in terms of an ominous rise in case counts, hospitalizations and the resulting reapplication of governmental restrictions on mobility and economic activity. On the other hand, investors received positive news around potentially highly effective Covid-19 vaccines first from Pfizer and BioNTech last week and then from Moderna this week. Given that the intrinsic value of stocks depends on their earnings potential over many years, the stock market appears to have been more sensitive to the positive developments related to the vaccine progress than they have been to the negative developments associated with the continued spread of the virus as evidenced by the market’s generally rise over the last six trading sessions.

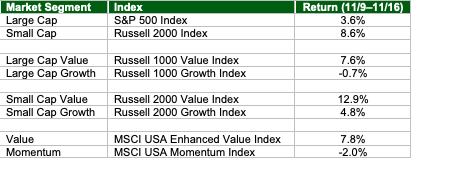

Beyond just the top-line market movements, the recent developments have triggered a strong internal style rotation with value and small cap stocks outperforming the broader market averages by noticeable margins. The table below presents that performance of a variety of market indexes since the beginning of last week right before news broke on the Pfizer and BioNTech vaccine. As we can see, small caps and value stocks have outperformed while large cap growth and momentum have comparatively lagged.

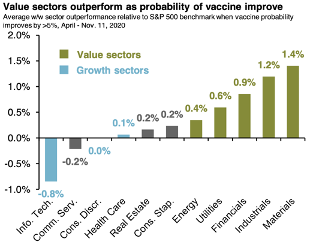

Analysts at JPMorgan pointed out recently that this phenomenon isn’t necessarily new as value outperformance has strongly correlated with positive developments on the vaccine front since as far back as April. Leveraging data from Good Judgement, a global network of professional forecasters who collaborate to tackle forecasting questions around complex macro themes, who has been polling its members on when an effective vaccine could be broadly distributed, JPMorgan demonstrated that when the probability of an effective vaccine being broadly distributed by the end of the first quarter 2021 has increased by more than 5% during a given week, traditional value sectors such as materials, industrials and financials have outperformed the broader market, on average. During those same weeks, traditional growth sectors like technology, consumer discretionary and health care have tended to lag. The chart below display’s JPMorgan’s findings.

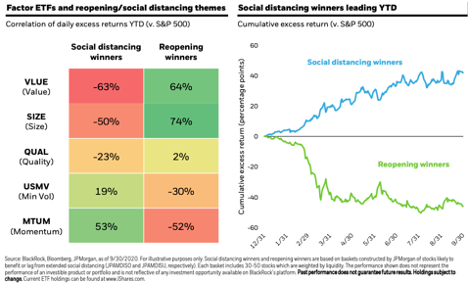

A separate analysis from BlackRock reinforces this theme and further points to the potential for continued value and small cap outperformance if further positive developments are made in terms of vaccine development and distribution such that it ultimately leads to the resumption of “normal” economic activity.

In its analysis, BlackRock relied on two indexes created by JPMorgan that seek to track the performance of stocks deemed to be “social distancing winners” (i.e., those stocks that benefit from continued restrictions on mobility and in person gatherings) and those that are deemed to be “reopening winners” (i.e., those stocks that benefit from more of a return to normalcy). BlackRock used these two indexes to see whether they could shed any light on the performance of various investment style factors such as value and momentum through the first nine months of the year.

The chart on the right below reveals that through the first three quarters of the year, the social distancing winners handily outperformed the reopening winners—a result that likely doesn’t come as a surprise to many. The chart on the left shows that statistically, the momentum factor has benefitted greatly from this trend as its performance has been positively correlated with the performance of the social distancing winners and negatively to that of the reopening winners. In contrast, the value and small size factors have seen their fates positively correlated with the reopening winners and negatively with the social distancing winners. Taken together, this analysis goes a long way toward explaining the comparative struggles of the value and small size factors through the first three quarters of 2020 and the strong outperformance of the momentum factor.

Both JPMorgan’s and BlackRock’s analyses strongly suggest that if positive developments can continue to be made with the respect to the efficacy of vaccines and their widespread distribution, the long anticipated rotation of market leadership from large cap growth and momentum stocks to value and small cap stocks may continue.

Important Disclosures

Kathmere Capital Management (Kathmere) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Kathmere and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Kathmere cannot guarantee the accuracy of the information received from third parties.

An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance to certain asset classes. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. Their performance does not reflect the expenses associated with the management of an actual portfolio. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing involves risk including loss of principal. Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market. Past performance is no guarantee of future results.

The S&P 500 Index or the Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies.

The Russell 2000 index is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index.

The term Russell 1000 Value Index refers to a composite of large and mid-cap companies located in the United States that also exhibit a value probability.

The term Russell 1000 Growth Index refers to a composite that includes large and mid-cap companies located in the United States that also exhibit a growth probability.

The MSCI Enhanced Value Indexes are designed to represent the performance of securities that exhibit relatively higher value characteristics within the parent universe of securities.

The MSCI USA Momentum Index designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably high trading liquidity, investment capacity and moderate index turnover.