26 Jul Life Moves Pretty Fast

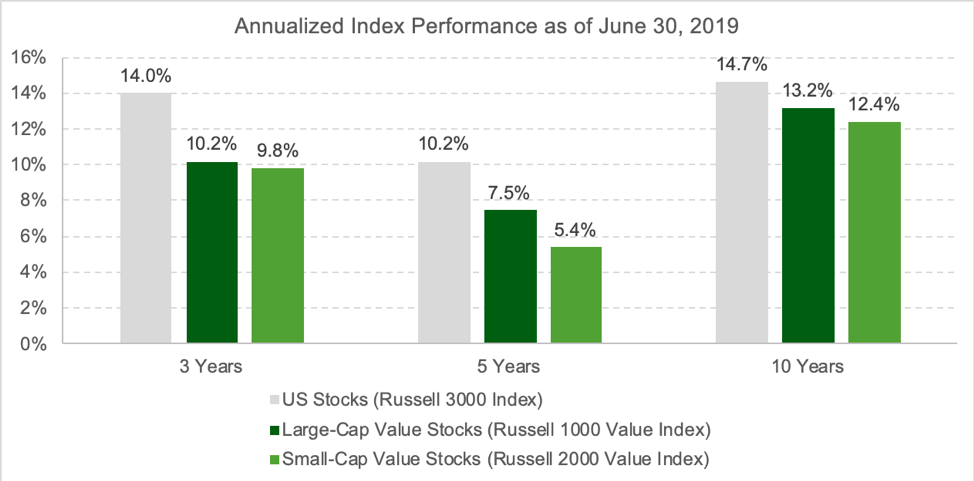

The renowned dispenser-of-wisdom, Ferris Bueller once said “Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.” I thought of this nugget recently when pondering the recent run of extended underperformance of value stocks—of both the large-cap and small-cap variety—relative to broader market indexes, something which we’ve covered on multiple occasions in the past on these pages. The chart below, which presents the annualized performance of U.S. stocks, U.S. large-cap value stocks and U.S. small-cap value stocks as of June 30, 2019, illustrates value’s tough run quite succinctly.

It’s quite understandable that one could look at this chart, observe that value stocks have trailed the broad market over the prior three, five and 10 years, and reasonably conclude that something is “broken with value” or simply that value is an inferior strategy. After all, we know intuitively that in many other facets of our day-to-day lives past performance is strongly associated with future performance. For example, Vanguard highlighted that “Performance ratings for goods and services as diverse as education, automobile purchases, fine dining, and health care can share similar predictability and, therefore, reliability: An institution, product, or service that is highly rated one year will likely be highly rated the next year, and a below-average-rated institution, product, or service one year will likely be similarly rated the next.”[1]

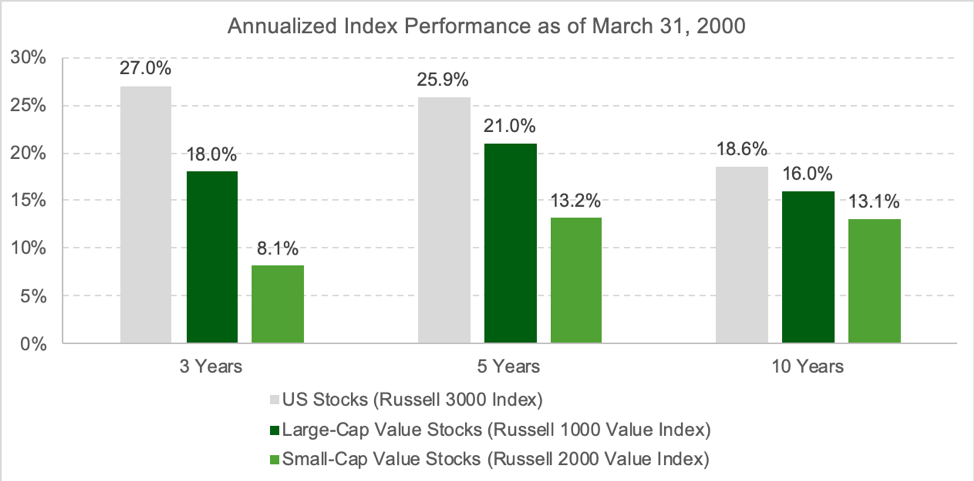

Unfortunately, when it comes to investing, recent, short-term performance doesn’t tell us much about what to expect in the years to come. Harking back to Ferris’ sage advice, let’s “stop and look around.” Specifically, let’s look around at how things appeared in early 2000—the last time value experienced a similar run of poor performance which had many investors questioning whether something had fundamentally changed in the so-called “new economy” such that value investing had been rendered a relic of the past. The chart below, which mirrors the one above, presents the performance of the same three indexes as of March 31, 2000.

[1] “Reframing investor choices: right mindset, wrong market.” Vanguard Research. September 2016.

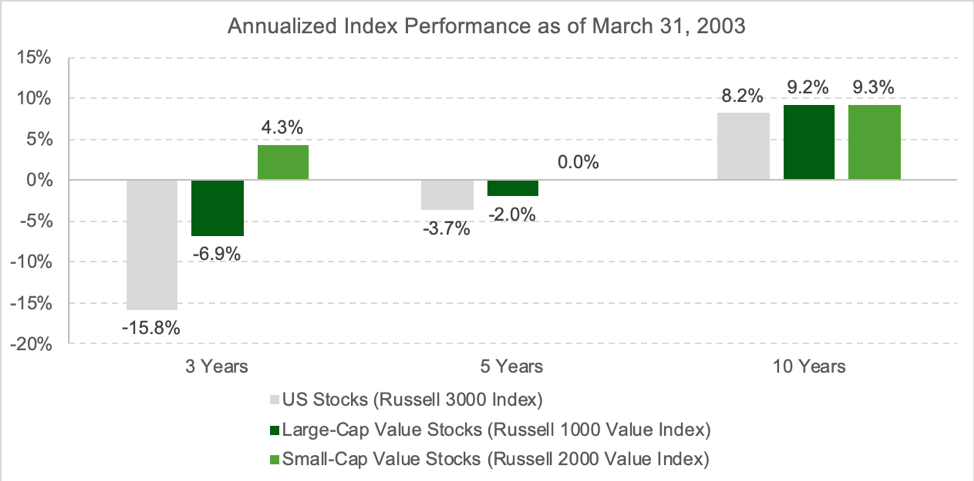

Quite similarly to today’s investor, an investor in March 2000 could observe value’s lackluster results combine it with a compelling argument that something was fundamentally different about the markets and the economy as a result of technological change and very reasonably conclude that value is likely to be a lousy strategy going forward and that they would be best served sticking to broad markets or even emphasizing value’s counterpart, growth stocks in their portfolio. The chart below, which fast forwards the clock to March 2003, demonstrates that an investor following this line of reasoning likely would have regretted their decision just three years later.

What a difference three years can make! Whereas value investing looked like a fool’s errand as of March 2000 when it had lagged the market over each of the observed trailing periods, just three years later, it was handily outperforming the market over these same trailing periods. The lesson to be gleaned from this anecdotal example? Life moves pretty fast. Don’t put too much stock in recent, short-term performance. And, stay disciplined even in the fact of temporarily disappointing results.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

All performance referenced is historical and is no guarantee of future results.

No strategy assures success or protects against loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All investing involves risk including loss of principal.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Private Advisor Group, a Registered Investment Advisor. Private Advisor Group and Kathmere Capital Management are separate entities from LPL Financial.